ADAM DARGAN, Residential Researcher, Construction Information Services, details key trends in residential building activity in the past 12 months and analyses applications granted for indications of what residential construction activity there may be in the coming year.

Over the past 12 months, the residential sector in Ireland has witnessed a slight slowdown across all facets of the planning and construction cycles. Even though the country is still in the middle of a severe housing crisis, the delivery target of new units to market, for either purchase or rent, has remained well below what the government is committing to deliver.

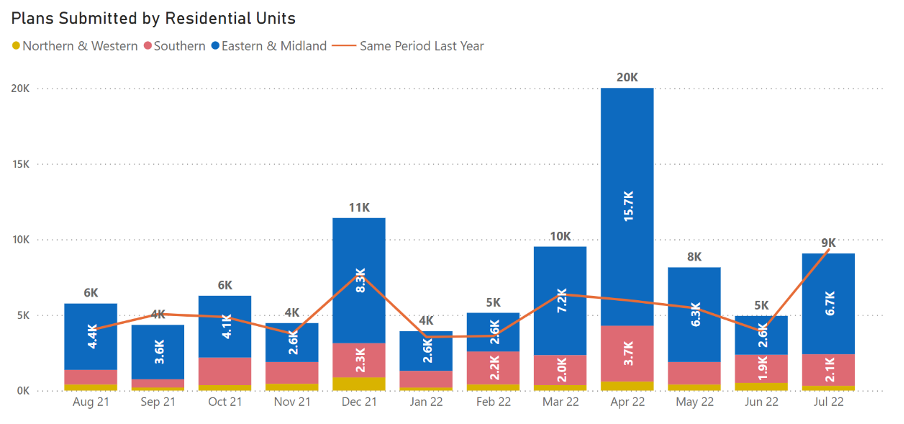

There has been a consistent trend in the volume of planning applications being lodged month on month for scheme housing and apartment developments over the past 12 months, albeit with a slight drop in August 2022.

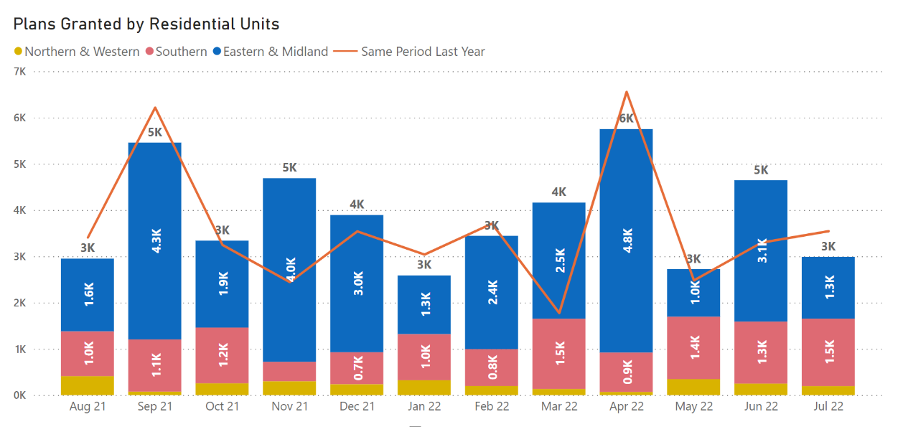

Regarding planning approvals on residential applications, CIS has witnessed again consistent volumes of residential applications being approved, with a peak in volumes in June 2022. However, as part of weekly planning appeal monitoring, we have observed significant delays in appeal decisions being made by An Bord Pleanála, which is impacting the progression of substantial volumes of projects. The lodging of judicial reviews in relation to Strategic Housing Development (SHD) applications has also resulted in delays in the progression of large-scale housing developments and student accommodation projects. With the conclusion of the SHD process in late 2021, it is undetermined if its successor, Large-Scale Residential Development (LSRD) applications, will prove to be a catalyst for construction uptake in the sector.

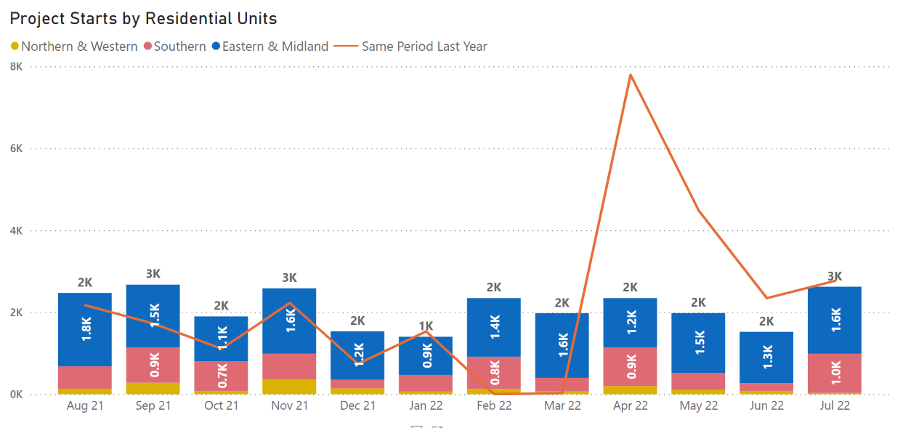

Activity on the ground remains consistent, though, with circa 2,000 units on average starting on site each month, be it new developments or new phases within existing ongoing sites. However, supply is significantly outweighed by demand, whether in the private rental market or the purchasing of new properties. The lockdown of the sector in Q1 2021, as a result of Covid-19, was followed by a real bounce in activity levels from Q2 2021 onwards, when the industry reopened.

Plans submitted

In the 12 months to July 2022, over 86,000 residential units were submitted for planning, with the largest region (Leinster) having over 67,000 units and the smallest region (Ulster) having just over 1,000 units. The number of plans submitted per month peaked in December 2021. The next busiest month was March of this year. The highest aggregate value of total projects peaked at €4bn. As the programme of SHDs came to a close in late 2021, there was a sharp rise in plans for SHDs in the preceding months. In fact, SHD applications continued to be lodged with An Bord Pleanála well into August 2022. From a broader perspective, there seems to be continuity in the number of projects being proposed in the past year. This would indicate that despite all recent challenges for the construction industry, sentiments for future developments have not been dampened.

The largest project lodged for planning in the past 12 months was within the Fingal County Council area. The project for Gannon Homes Limited proposes over 2,500 units in Malahide Road, Dublin 17. The project designed by Wilson Architecture and Conroy Crowe Kelly comprises circa 2,000 apartments (558 of which are build-to-rent units) and almost 500 houses. Other elements planned include 18 retail units, cafés, restaurants and childcare facilities. A decision is expected in Q4 2022.

Plans approved

Over the past 12 months, over 43,000 units were granted planning permission. With the largest region (Leinster) having over 29,000 units and the smallest region (Ulster), 560 units.

There has been a stable number of projects being granted in the past year. This again implies that there is a sentiment in the market that there are still potential profits in development in the near future.

The largest project to receive planning approval in the last 12 months was within Dublin City Council’s area. The project for Hines proposes 1,614 build-to-rent units at a site at Holy Cross College on Clonliffe Road, Dublin 3. The project has been designed by Henry J Lyons Architects and will see a mix of one-, two- and three-bedroom units set out in 12 residential blocks ranging in height from two to 18 storeys.

Project starts

A total of 2,240 new projects commenced over the past 12 months, equating to over 24,000 units, with the largest region (Leinster) seeing over 16,000 units commence and the smallest region (Ulster), circa 500 units. The distribution of units commenced is linear across the board, with approximately 2,000 to 3,000 units per month starting on site.

The largest project to commence on site in the past 12 months was again in Dublin City Council’s area. The project for Cairn Homes Plc comprises 730 units at Parkside in Dublin 13. The project has been designed by C+W O’Brien Architects and will see a breakdown of 316 one-bed, 376 two-bed and 36 three-bed apartments. Works commenced in July of this year, with 238 units currently under construction.

Residential units completed

Over the past 12 months, 16,149 residential units were completed, with the largest region (Leinster) having 11,738 units and the smallest region (Ulster), 446 units. These units would derive from both completed developments and units completed within ongoing developments. The mix comprises scheme housing, apartment developments and mixed residential projects.

One of the largest projects to be completed within the last 12 months was within Meath County Council. The project for Glenveagh Properties Plc, which commenced in H2 2019, sees the delivery of close to 170 new houses brought to market in a mix of three- and four-bed units. Designed by AKM Consultants, Oldbridge Manor also includes a single-storey childcare facility.

In conclusion

The demand for housing is currently outweighing the supply, which will continue to have a significant impact on Ireland’s ever-increasing population and the generations to come. A number of factors have contributed to this imbalance and impact on the delivery of housing.

Increases in the cost of vital materials required for housing have many developers questioning the viability of the construction of large-scale housing projects. This is coupled with a shortage of labour, with many qualified tradespeople seeking a change of career or migrating to countries with a more favourable cost of living climate.

Planning has also been blamed for the delivery delays, with many developers greatly concerned about how time-consuming and expensive the process of getting development sites green-lighted and shovel-ready. The appeals process has also caused a bottleneck for activity progression, with decisions delayed by several months by An Bord Pleanála.

CIS has seen a slight drop in the sentiment toward new planning for housing being submitted to local authorities. However, at present, there is planning permission in place for tens of thousands of units. We need to see units built and delivered to public and private markets and those optimistic delivery targets being met.

Remote and hybrid working models, which have become the new normal following the Covid-19 pandemic, will also see new requirements for housing to facilitate this new working environment. With winter approaching, it remains to be seen if another wave of Covid-19 will impact ground activity.

*Information correct as of 24th August 2022 and Excludes the Self-build market

For more details on Residential Project information and Analysis, please visit www.cisireland.com or call 01 299 9200 to speak with the Construction Information Services research, sales and insights teams.