– Almost 50,000 new housing units per annum now needed

Mitchell McDermott Annual Construction Sector Report 2023 shows construction costs of apartments rose by 9.6% in 2022

The construction costs of a two-bed mid-range apartment increased by 9.6% or between €21,000 to €25,000 last year, according to the Mitchell McDermott Annual Construction Sector Report 2023. The consultants found that the hard cost of building a two-bed, medium-rise suburban apartment is now over €240,000.

The main contributors to the increase are mechanical and electrical services, up 18%, concrete up 27%, brickwork, up 39% and reinforcement steel, up 17%.

The €240,000 figure excludes indirect costs, parking, siteworks, margin and VAT. If those are included, the total cost of delivering the apartment is in the region of €460,000; the sales price would have to equal or exceed this.

Mitchell McDermott Annual Construction Sector Report 2023

After a rollercoaster of a year, general construction inflation increased by 12% in 2022 but is expected to moderate to between 5% and 7% in 2023.

The reason apartment cost inflation is lower than general inflation is because the facades of offices comprise expensive materials such as metals, glass, steel and aluminium, and these products were more exposed to price increases.

Construction costs

Paul Mitchell, one of the report’s authors, said that while 2022 was a year of two halves, there are some signs we may be coming to the end of the current inflationary cycle.

“Construction inflation was on the rise in the early months of 2022 but really began to take off following Russia’s invasion of Ukraine, mainly due to the dramatic rise in materials such as steel and other energy-intensive materials such as aluminium and brick. Material prices began to moderate in Q3 and encouragingly plateaued in Q4. For apartment cost inflation, the figure for H1 was 6.8%, while in H2, it was 2.8%. So, we are trending in the right direction.”

Construction employment

“Although the number of people employed in construction increased by 25,000 in 2022 to 171,000, we will need another 20-30,000 in the short-term if we are to push inflation lower while increasing apartment output. Given Ireland’s low unemployment rates and the departure of many workers to their home countries post Covid this will be a real challenge.”

Judicial reviews

According to the report, there was a 79% drop in the number of judicial reviews (JRs) taken against Strategic Housing Developments. This was even though 2021 saw the highest number of SHDs ever submitted in advance of the scheme being phased out in place of a new Large-Scale Residential Development scheme.

Paul Mitchell says they discovered the reduction was due in large measure to a massive drop off in the number of decisions being made by An Bord Pleanála on SHDs.

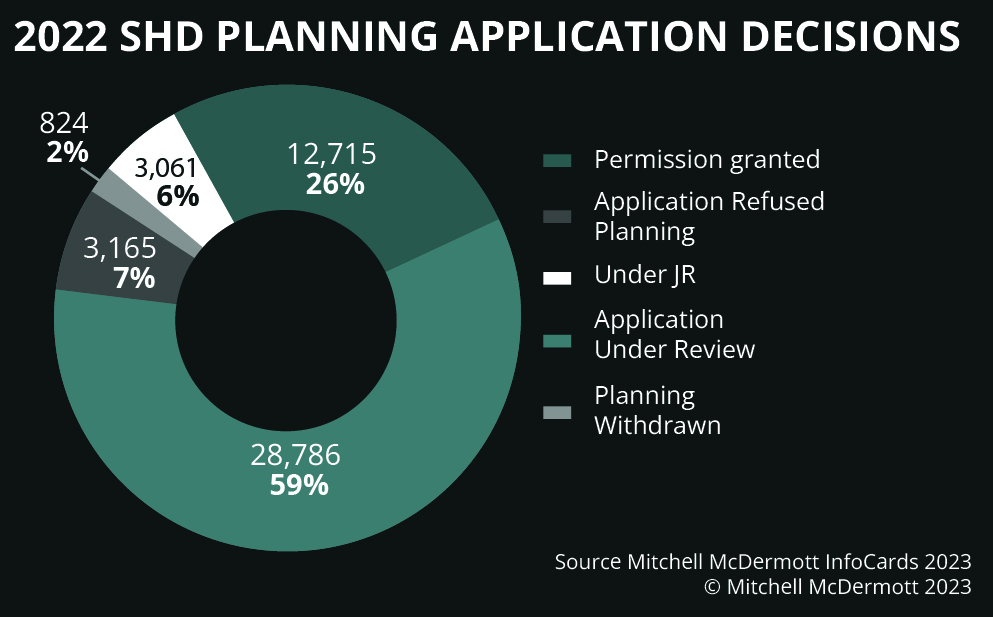

“Our analysis of SHD applications in 2022 found that while An Bord Pleanála had granted permission for 26% of applications or almost 13,000 units, it has yet to decide on 59% of submissions made to them – a total of 28,786 units. Everyone knows the Bord has had its issues this year but to have so many units delayed amid a housing crisis is unacceptable. You would imagine this backlog could easily be addressed by drafting in additional temporary resources from private practice here or from the UK, and we believe this should be done straight away.

“Delays due to judicial reviews and spiralling construction inflation have all contributed to the dramatic drop off in commencements we are seeing. The fact institutional investors have begun moving away from property investment as interest rates continue to rise has created a very challenging environment and one in which the government will clearly struggle to hit their Housing for All targets of 33,000 units per annum.”

Almost 50,000 housing units per annum needed

“However, we believe the real need is closer to 50,000 units a year, and in order to scale up supply, the priority must be to put a functioning planning system in place. An average apartment block of 150 units can take four years from site purchase to delivery of the first unit. This excludes JR’s and planning delays. While there was a major fall in the number of JRs last year, our analysis shows a total of 31,125 units in SHDs which received planning permission have been subjected to judicial reviews over the past five years. Just 10% or so have gone ahead, 10,727 units were quashed, while 17,805 are still awaiting a decision from the courts – a total of 28,532 units,” Paul Mitchell concluded.

For more details, please visit https://mitchellmcdermott.com/infocards/