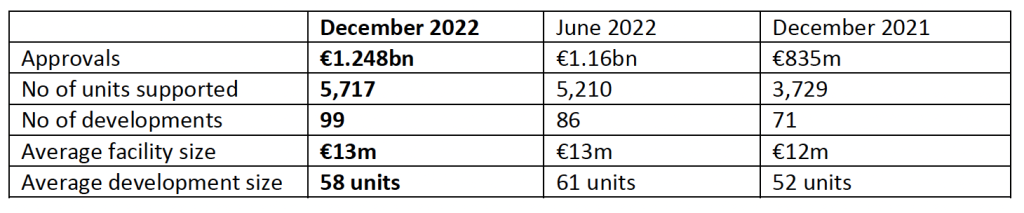

– Funding approved for 5,717 homes in 99 developments in 21 counties (68% houses, 32% apartments)

Home Building Finance Ireland (HBFI), set up by the Government to fund the delivery of new homes, has grown total loan approvals to €1.248bn at the end of 2022, an increase of 49% on the €835m at the end of 2021.

In its year-end performance update, HBFI said that at the end of 2022, it had approved funding for 5,717 new homes in 99 developments in 21 counties. Social housing accounts for 25% of the new homes approved for funding. A total of 1,245 HBFI-funded units have already been sold, with a further 1,819 contracted for sale or sale agreed as at the end of 2022.

HBFI Loan drawdowns

Of the €1.248bn approved, drawdowns have taken place in respect of facilities totalling €909m (73%), for 60 developments totalling 4,132 units where construction is in progress or has been completed. HBFI typically expects a time lag of between three and six months between a loan being approved and its first drawdown. 70% of homes funded by HBFI consist of three- two-bed units aimed at the first-time buyer market.

Individual loan facilities range from €1m to €94m, with an average size of €13m.

Home Building Finance Ireland

Commenting on the update, Dara Deering, Chief Executive, HBFI, said: “We’re continuing to make a difference for owner-occupiers, renters and people who need social and affordable housing by adding much-needed new supply to all of these sectors. We’re lending to large and small housebuilding firms, extending our reach to improve supply as much as we can.

The first half of 2022 was our busiest-ever six-month period in terms of loan approvals and, while we saw a lower level of applications and new approvals in the second half reflecting a slowdown in construction activity across the market, feedback from housebuilders indicates that demand for new funding is resilient.”

Housing for All

The Minister for Finance Michael McGrath, commented, “HBFI was established as an important government initiative to address a shortfall of finance available for the construction of residential housing in the State. Through its broad product range, and agile business model, HBFI plays a key role in the Government’s strategy to meet the targets set out under Housing for All.”

HBFI’s key metrics showing end of December 2022 performace compared to June 2022 and December 2021 as follows