What to do to minimize the impact of the hard insurance market

Reduce construction insurance costs

The signs would suggest that a hardening of the rates and an increase in premium for Employers’/Public Liability (EL/PL) insurance for the construction sector is on the cards and may be imminent. However, there are a few things that you can do that could reduce construction insurance costs for your company.

As widely reported, motor insurance (including fleet and commercial vehicle insurance) is now going through a very difficult time with limited availability (capacity) in the market leading to significantly increased premiums (reports vary from 25% to 500%). As a general rule, the hardening of the motor market is a precursor for similar in the EL/PL market.

The reasons for the increases are varied and complex but include the following:

- There is clear evidence that the increase in the jurisdiction of personal injury awards in the Circuit and District Courts has led to very significant claims inflation. The news media is full of reports of alarming court settlements. For example:

- In one case at the High Court in Limerick, an award of €508,000 and legal costs of €220,000 was made following a “relatively straightforward” road traffic accident. The plaintiff’s solicitor had been seeking only €150,000 and legal costs had initially been expected to be €71,000.

- In Sligo, the court awarded €278,000 and legal costs of €122,000 where the plaintiff had been seeking €100,000.

- In a Galway case, a plaintiff had sought €100,000 before the case began, but the judge awarded €175,000.

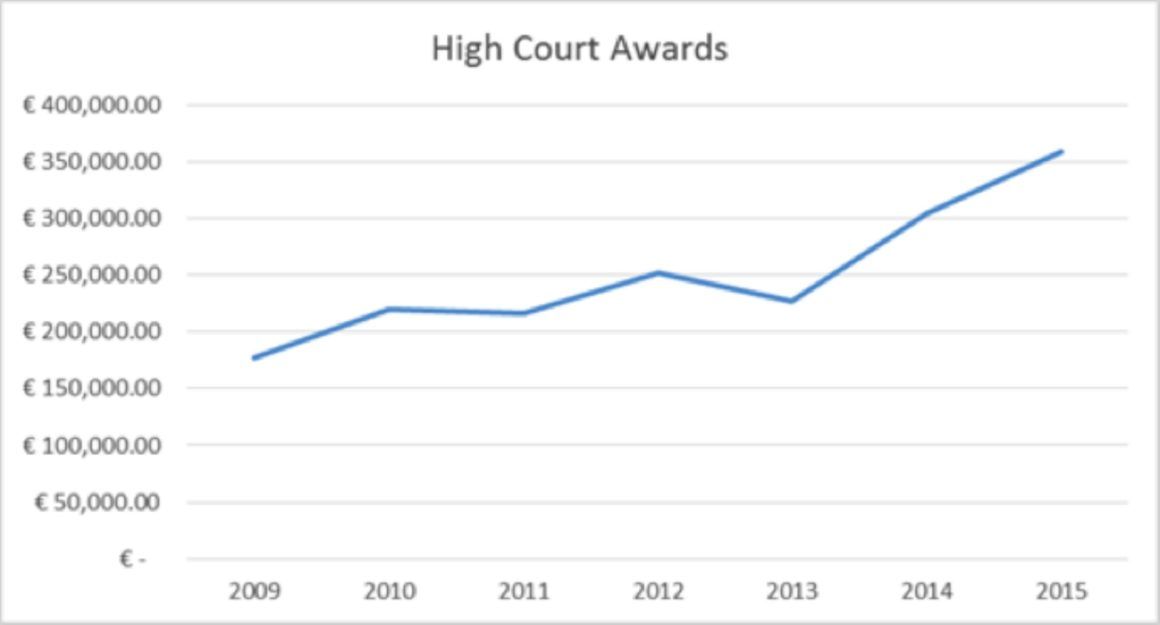

This graph illustrates the sharp increase in Court awards

Whiplash awards

The majority of all car insurance pay-outs are for whiplash-related injuries, it has been claimed. Irish Insurance Federation chief Kevin Thompson said the average pay-out was €15,000 which is driving up the cost of motor premiums nationwide. He added legal costs were another serious issue for the industry as they account for up to 60% of all pay-outs when the case goes to court.

AIG spokesman Declan O’Rourke says: “In France and Germany the normal award for whiplash is between €2,000 and €3,000 and the legal fees are in the hundreds. In Ireland, the average award for whiplash is €15,000. So we have the most expensive necks in Europe”.

Litigation Culture

Employers’’ body IBEC said “excessive judicial awards and a litigation culture” were feeding into higher consumer prices, and even minor accidents were increasingly prompting compensation claims. At the launch of its report, Time to Reduce the Burden of Personal Injury Claims, IBEC said even when liability is not contested those claims often lead to unnecessary, costly court cases.

In Ireland, courts are guided to award between €16,000 and €35,000 for an ankle fracture, whereas courts in England and Wales can award up to a maximum amount of €14,000 for a similar injury.

Four Tips to reduce construction insurance costs

Having set the scene (albeit very briefly) here are some suggestions as to what might be done to mitigate, in so far as is possible, the effects of a hard market and possibly reduce construction insurance costs for your company:

(1) Choose your Insurer carefully and try to get a long term deal

The EL/PL insurance sector (particularly for construction) is littered with Insurers who come and go and this does not do the construction industry any favours. Against that background, there are a number of Insurers in the market who have been around through thick and thin and, while they are not always the most competitive at any given point in time, they offer great value over an extended timeframe due to their consistency and stability. At this point in the market cycle, for companies looking to reduce construction insurance costs it would be wise to “get in” with one of these Insurers (if you are not already there) and try to secure your rates/premium for a two or three year period. This will give you a cushion and will mean that you can price work knowing what your insurance costs are going to be.

Many people will remember the extremely sharp spike in premiums around 2002/2003 following the collapse of one major insurance company and the withdrawal from the market of a number of others, which led to premium hikes of 500% or more – at that time, companies who were insured with the “stable market” tended to fare much better than others.

(2) Good risk management and claims management

Good risk management and claims management is always key to securing the best possible insurance terms. If a contractor can clearly demonstrate better than average safety management structures, there is a far better chance of securing favourable terms. Factors which should be considered and should be brought to your Insurers attention are:

-

Information on your in house safety management capabilities and/or the engagement of experienced, qualified and reputable external consultants

-

Any industry accepted safety awards (particularly the CIF’s Safe T Cert)

-

The ability to demonstrate that you have an effective accident reporting procedure and claims management capability. Your Broker should be able to advise you on what is appropriate but it in order to help reduce construction insurance costs should include, as a minimum, the following:

- Detailed accident report including on the spot witness statements, photographs and as much detail of the incident as possible.

- Follow through procedures (if appropriate) with the injured party.

- A policy on implementation of changes to work practice following an incident or an “near miss”.

(3) Consider taking on an increased claims excess

If you are in any financial position to do so, and are satisfied with your Risk Management and Claims Management procedures, you might consider taking on an increased claims excess (deductible) either in the aggregate or for each and every claim. Most Insurers, who are committed to the market, will happily buy into such an arrangement and will support you in circumstances (such as Government contracts) where increased excesses are not permitted.

(4) Choose your Insurance Broker carefully

Finally, choose your Broker carefully. Construction insurance is becoming ever more complicated and a Broker with specialised knowledge of (a) the construction insurance market and (b) the requirements of the various contract and sub–contract conditions is absolutely essential.

Post courtesy of Capital Cover Group, Official Brokers to The Construction Industry Federation (CIF) with a track record going back 30 years or more in the construction sector. Contact David Lynch on 087 2471121 or dlynch@cib.ie

David Lynch

Opinion